Getting out of credit card debt may be time-consuming and challenging especially if you don’t have a debt payoff plan. People don’t like talking about debt but thousands of us have it. Are you ready to tackle your current credit card debt and finally get rid of it?

In this article, we are going to share with you some of the most effective debt repayment strategies including switching to a balance transfer credit card.

Contents

5 Money Tips To Tackle Credit Card Debt

We all may experience temporary monetary issues. It may happen all of a sudden and we just use our credit card to cover the bills or make an important purchase. Consumers who fail to be consistent with their bill payments may damage their credit scores.

Later, they will need to rely on bad credit loans Quebec to take out more debt. This cycle may become endless if you don’t understand that you need to break it and create a certain debt repayment plan. The following tips will assist you in the debt payoff process and prevent your credit card account from growing.

1. Make A Budget

There is nothing better than creating a budget. It will be responsible for your expenses and income. Those who are freelancers and have several streams of income will have to add up their invoices to make an average monthly budget. Those with a regular full-time position will have consistent and straightforward income. You should do a real accounting of your overall costs for the month.

Fixed expenses and necessities such as rent or mortgage, transportation costs, and food may comprise the largest part of your income. Later, you should also include your variable costs such as clothing, mobile phone bill, entertainment, and any subscriptions.

After you subtract your overall costs from your overall income, you should have something left. This amount should go toward your debt payoff. Once the debt obligations are returned, you should allocate this portion of your income into your savings.

2. Pay More Than The Minimum

You may check your credit card statement for the required minimum sum you should make every month. If you don’t make the minimum payment on each of your credit cards, your credit rating may get damaged. Thousands of Canadians own multiple credit cards and fail to keep their balances low or forget about them. If you want to eliminate your current debt, you need to make more than the minimum monthly payment on each card you have.

Remember that the interest will be charged on the amount you owe. The common reason why this type of debt accumulates and turns into a snowball is compound interest. Making larger payments will go toward interest rate payoff in the first place and reduce your compounding interest helping you maintain your score in good standing.

3. Choose A Balance Transfer Credit Card

Now that you understand how your credit rating depends on your payment history and why compound interest can quickly add up, you may want to select a card with a lower rate than you are currently having. It will help you catch up on your present debt obligations and allow you to avoid compound interest.

If you are thinking about getting a balance transfer credit card instead of your high-interest one, you need to look at the transfer fee, the interest rate, as well as the time period. Some crediting tools offer a promotional 0% interest rate during the first year. This great offer gives you a chance to use these 12 months for debt repayment.

4. Build Your Emergency Fund

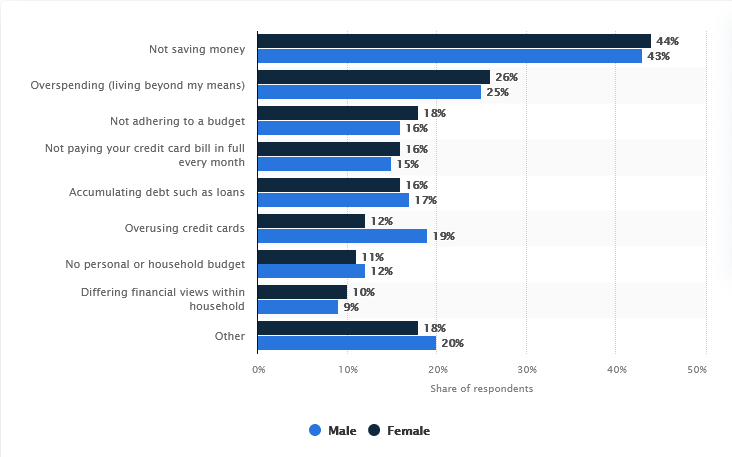

According to the recent survey on financial stress factors among Canadians by Statista, overusing credit cards was a stress factor for 12 percent of female Canadians.

When it comes to your finances, which of the following habits do you feel causes you stress?

Source Link: https://www.statista.com/statistics/473727/stress-causing-financial-habits-canadians-by-gender/

So, it’s really important to improve your financial habits to avoid money-related stress. Building your emergency fund is one of the most significant steps to reaching financial freedom. It will give you the independence to cover all the necessary purchases and have your own money set aside for emergencies.

It’s much better than turning to a lending tool each time you urgently need to finance your bills as you won’t need to pay interest or return this debt to anyone. Be consistent and save a portion of your monthly income to establish your emergency fund. Don’t use this fund for covering daily expenses; it should serve just as your safety cushion.

5. Consolidate Your Debt

This is another suitable way of solving your financial struggles. Debt can be overwhelming and frustrating. If you have several credit cards you can’t pay off, you may want to consolidate them. Getting a lower-interest credit tool will help you make just a single monthly payment while also reducing the debt load as well as the interest. Of course, a consumer needs to have a good credit rating to apply for a lower-interest option.

It’s much easier to keep track of a single payment instead of multiple ones. What can you do if your credit rating is too poor to consolidate debt? If you want to get extra assistance to repay your current debt, you shouldn’t postpone it. The Government of Canada offers you to contact a financial advisor, an accredited nonprofit credit counselor, or a Licensed Insolvency Trustee. You will be able to get professional help to make your budget, evaluate your present debt situation, find suitable ways to repay debt, and define your financial needs.

Make A Specific Financial Plan

As you can see, getting rid of your current credit card debt isn’t a one-day process. It requires some time and effort so having a certain financial plan is essential. When you follow these steps and have a decent repayment plan, it will help you be motivated and focused on your aim. You need to repay an existing debt to start setting goals for the future.

The debt payoff process may be time-consuming as you will need to allocate quite a large portion of your income toward debt obligations. It’s always easier to take out debt than to repay it. Having a financial plan, you will notice the larger picture of your present monetary situation.

The Bottom Line

It isn’t an easy duty to pay down your current credit card debt. Use this information and professional pieces of advice to tackle it, lower your spending, make a budget, consolidate your debt, and free the finances you need to become financially independent again.